Cooking the Perfect Roast in a Slow Cooker: A Step-by-Step Guide

Before we look at recording and posting the most common types of adjusting entries, we briefly discuss the various types of adjusting entries. The accounting period a company chooses to use for financial reporting will impact the types of adjustments they may have to make to certain accounts. Let’s say a company has five salaried employees, each earning$2,500 per month. In our example, assume that they do not get paidfor this work until the first of the next month. Accrued expenses are expenses incurred in aperiod but have yet to be recorded, and no money has been paid.Some examples include interest, tax, and salary expenses.

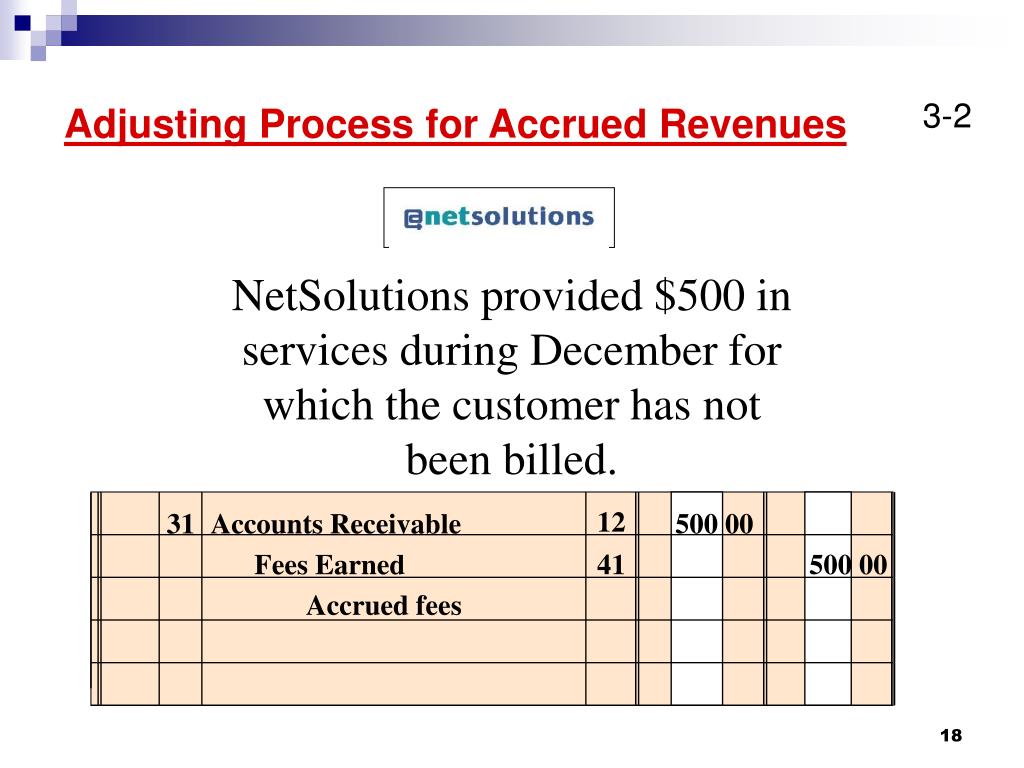

Accrued Revenues

At the time of purchase, such prepaid amounts represent future economic benefits that are acquired in exchange for cash payments. This means that adjustments are needed to reduce the asset account and transfer the consumption of the asset’s cost to an appropriate expense account. On January 9, the company received $4,000 from a customer for printing services to be performed. The company recorded this as a liability because it received payment without providing the service. Assume that as of January 31 some of the printing services have been provided. Since a portion of the service was provided, a change to unearned revenue should occur.

- All public companies that do business in the U.S. are required to file registration statements, periodic reports, and other forms to the U.S.

- The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements.

- Subsequent to the adjustment process, another trial balance can be prepared.

- For example, a company performs landscaping services in theamount of $1,500.

Accrued Salaries

For example, a company performs landscaping services in theamount of $1,500. Atthe period end, the company would record the following adjustingentry. Accrued revenues are revenues earned in aperiod but have yet to be recorded, and no money has beencollected. Some examples include interest, and services completedbut a bill has yet to be sent to the customer. Insurance policies can require advanced payment of fees forseveral months at a time, six months, for example.

Why Is the Accounting Cycle Important?

Make sure to coat the roast evenly, paying attention to any crevices or folds in the meat. The best type of roast for slow cooking is a tougher cut of meat, such as chuck, brisket, or round. These cuts have more connective tissue, which breaks down during the slow cooking process, resulting in tender and flavorful meat. Avoid using leaner cuts, such as sirloin or tenderloin, as they may become dry and overcooked. Once the roast is cooked to your liking, remove it from the slow cooker and let it rest for minutes.

Financial Accounting I

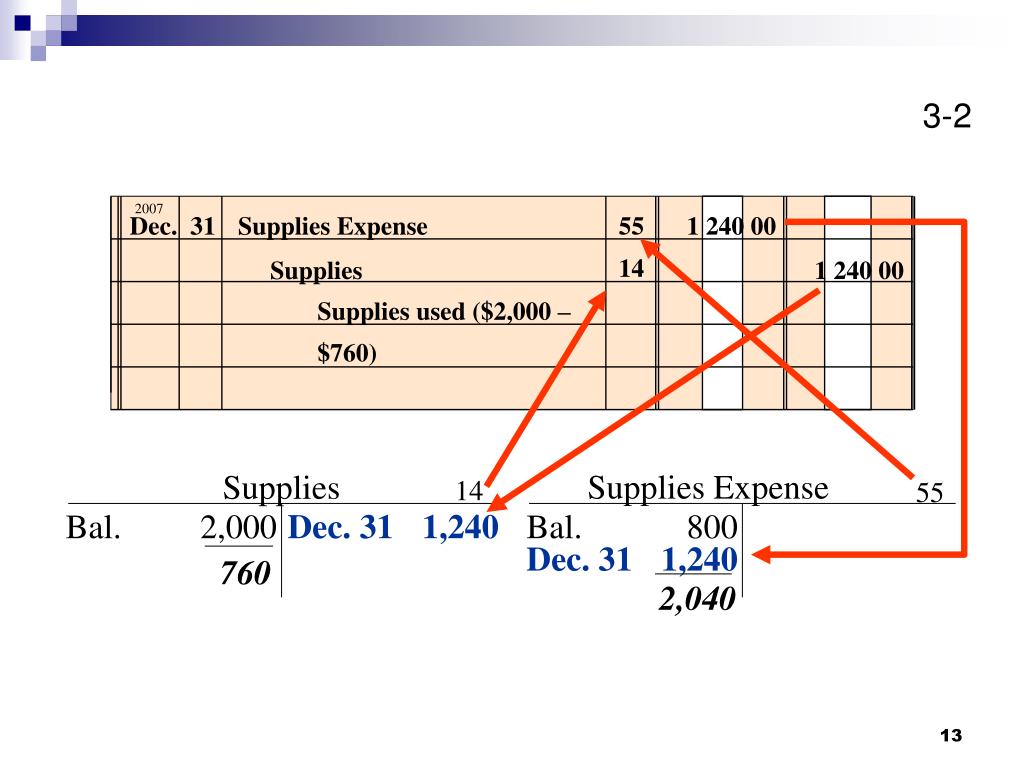

In other words, the ongoing business activity brings about changes in account balances that have not been captured by a journal entry. Time brings about change, and an adjusting process is needed to cause the accounts to appropriately reflect those changes. When a company purchases supplies, the original order, receipt of the supplies, and receipt of the invoice from the vendor will all trigger journal entries. This trigger does not occur when using supplies from the supply closet. Similarly, for unearned revenue, when the company receives an advance payment from the customer for services yet provided, the cash received will trigger a journal entry. When the company provides the printing services for the customer, the customer will not send the company a reminder that revenue has now been earned.

( . Adjusting entries that convert liabilities to revenue:

If so, this amount will be recorded as revenue in the current period. Each entry has one income statement account and one balance sheet account, and cash does not appear in either of the adjusting entries. Recall that unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the company. Click on the next link below to understand how an adjusted trial balance is prepared. Each entry has one income statement account and onebalance sheet account, and cash does not appear in either of theadjusting entries.

Keep in mind that the trial balance introduced in the previous chapter was prepared before considering adjusting entries. Subsequent to the adjustment process, another trial balance can be prepared. This adjusted trial balance demonstrates the equality of debits and credits after recording adjusting entries. Therefore, correct financial statements can be prepared directly from the adjusted trial balance.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. One difference is the supplies account; the figure on paper does not match the value of the supplies inventory still available.

Two main types of deferrals are prepaid expenses and unearned revenues. Prepaid expenses (prepayments) are assets for which advanced payment has occurred, before the company can benefit from use. As soon as the asset has provided best cash back business credit cards of november 2021 benefit to the company, the value of the asset used is transferred from the balance sheet to the income statement as an expense. Some common examples of prepaid expenses are supplies, depreciation, insurance, and rent.

Accumulated Depreciation is contrary to an asset account, such as Equipment. This means that the normal balance for Accumulated Depreciation is on the credit side. Accumulated Depreciation will reduce the asset account for depreciation incurred up to that point.

It is because of accrual accounting that we have the revenue recognition principle and the expense recognition principle (also known as the matching principle). Deferrals are prepaid expense and revenue accounts that have delayed recognition until they have been used or earned. This recognition may not occur until the end of a period or future periods. When deferred expenses and revenues have yet to be recognized, their information is stored on the balance sheet. As soon as the expense is incurred and the revenue is earned, the information is transferred from the balance sheet to the income statement.